Demystifying onramps and offramps

We have conversations every day about onramps and offramps with new stablecoins. There is some overlap with onramps and offramps for native tokens (ETH), but the flows need to work differently for stablecoins in some small but important ways. In this post, we hope to share some of these learnings.

What is an onramp?

In FinTech, this is called a deposit workflow. The nomenclature of an “onramp” can get in the way because it tells an emotional story of money leaving and going somewhere else. That’s not really the case - the money is just available on a protocol the same way it would be available in a more traditional FinTech balance.

Many onramps including Coinbase, Stripe, Moonpay, etc. work wonderfully for established tokens (BTC, ETH, USDC, etc.) with no real problem other than fees can be prohibitive to users. Some of these even support Brale-issued stablecoins which we are thrilled about.

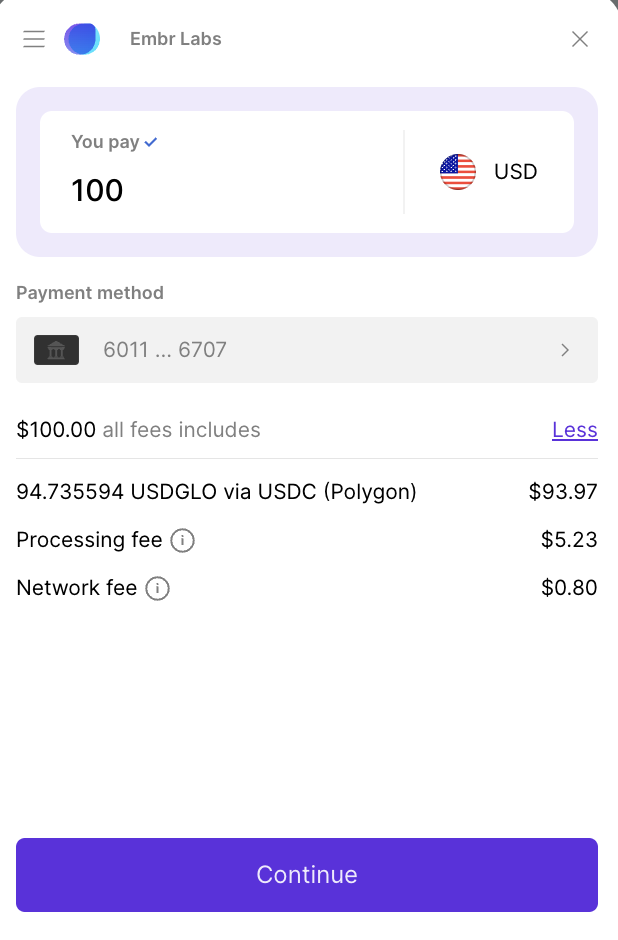

Two popular routes for new stablecoin programs are to get listed with leading ramps, or to use new solutions like Embr, Decent.xyz, and Fun.xyz which allow users to make a fiat purchase to a well-known stablecoin like USDC and swap it to an up-and-coming stablecoin, like USDGLO.

These processes work, but they still aren’t as user-friendly as loading a wallet balance in Venmo or Square Cash. When it comes to everyday use and onboarding more people to the technology, we see this as a bit of a barrier. While this isn’t a fully solved problem, there are solutions.

Business on and off ramps

Businesses expect to acquire stablecoins via wire transfer, ACH, and other typical B2B funding methods. Brale supports all of these, and any new stablecoin can send their early partners directly to Brale to buy and sell. All accounts support onramping and offramping new stablecoins with USD or USDC.

While this is helpful to get new stablecoins off the ground, this isn’t good enough for many applications. Many programs want to embed an onramp into a wallet or another product they are building. One solution is to simply work with leading onramp providers and pay the fee to have an asset listed.

Consumer on and offramps

Today Brale does not yet support stablecoin on and offramping for consumers, so the best solution is to work with an existing provider and pay a listing fee to support the stablecoin. Working with leading ramps also has the benefit of being integrated directly into wallets (Metamask) and ramp aggregators like OnRamper and Meld.

Coinflow makes it easy to support real-time stablecoin payouts, including all Brale-issued stablecoins, via ACH and Push-to-card. Coinflow has abstracted away all of the complexity so the user experience feels like withdrawing a stablecoin from Venmo and or other leading web2 payment experiences.

To help solve the onramping challenge for new stablecoins, Brale is also developing 1:1 consumer ramp that feels like everyday FinTech applications. The ramp will be feeless and support bank transfer to all Brale-issued stablecoins in supported U.S. states. This is especially helpful for emerging ecosystems, who are often not supported by existing ramp providers.

Onramps for new stablecoins

While each new stablecoin program is unique, we’ve found this to be a typical path to supporting stablecoin onramps in stages:

List the stablecoin on Brale’s exchange as the first onramp/offramp, making your stablecoin available to U.S. businesses. This listing also enables secondary global access through OTCs and liquidity providers like 1Konto, which can serve businesses in other parts of the world.

Establish on-chain liquidity on Uniswap and leading DEXs against USDC to make the stablecoin broadly available in DeFi. With liquidity established. ramps like Decent.xyz will support on-ramping to your stable via bank transfer or card, leveraging existing fiat → USDC ramps and swapping to the stablecoin on the backend.

Work with major ramp providers to get the asset listed, in order to embed the experience into your application and support additional currencies and payment methods.

We’re happy to make introductions to ramp providers based on your goals. To learn more, please reach out to our team.

Collaborate with our team to support onramps for your stablecoin.